The importance of Saving

This page may contain affiliate links. If you choose to purchase after clicking a link, I may receive a commission at no extra cost to you.

Saving is the act of setting aside a portion of your income for future use. Saving can help you achieve your short-term and long-term financial goals, such as buying a house, paying for education, or retiring comfortably. Saving can also provide you with a sense of security, peace of mind, and freedom from financial stress.

However, saving is not always easy. Many people struggle to save money due to various reasons, such as low income, high expenses, debt, inflation, or lack of financial literacy. According to a survey by Bankrate.com, only 39% of Americans have enough savings to cover a $1,000 emergency expense, while 28% have no emergency savings at all.

Don’t drown in debt

One of the biggest obstacles to saving is the temptation to spend money on things that are not essential or beneficial in the long run. For example, many people use credit cards or borrow money on hire purchase agreements to buy things that they cannot afford with cash. This can lead to a cycle of debt, interest payments, and reduced savings.

Credit cards and hire purchase agreements are forms of consumer debt that charge high interest rates and fees. Credit cards allow you to borrow money up to a certain limit and pay it back over time with minimum payments. Hire purchase agreements allow you to buy goods or services and pay for them in installments over a period of time.

While these forms of debt can be convenient and useful in some situations, they can also be very costly and risky. If you do not pay off your balance in full every month or miss a payment, you will incur interest charges and penalties that will increase your debt and reduce your savings. Moreover, if you default on your debt or become unable to pay it back, you may face legal action, damage to your credit score, or loss of your assets.

Therefore, it is important to avoid or minimize the use of credit cards and hire purchase agreements as much as possible. Instead, you should try to save money in advance for the things that you want or need, or look for cheaper alternatives. This way, you can avoid paying interest and fees, reduce your debt burden, and increase your savings.

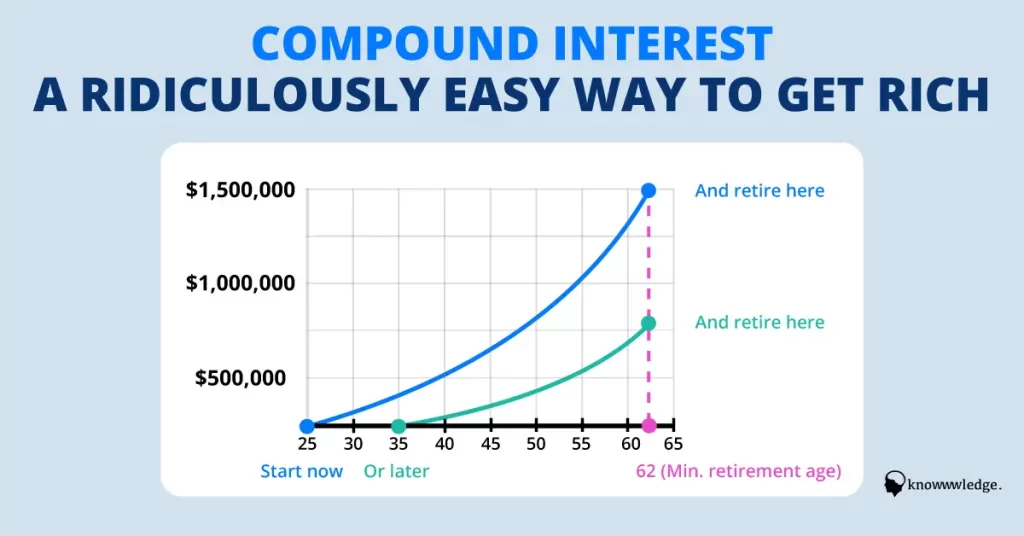

Compound interest – Your new best friend

(If Warren Buffett loves it – So should you)

One of the best ways to save money is to take advantage of compound interest. Compound interest is the interest that you earn on your initial principal as well as on the interest that accumulates over time. Compound interest can make your money grow faster than simple interest, which is the interest that you earn only on your initial principal.

Compound interest is the eighth wonder of the world.

Albert Einstein

Whilst it might seem like an exaggeration, this quote could not be more true when it comes to finance.

For example, suppose you have $1,000 and you invest it in a savings account that pays 5% annual interest compounded monthly. After one year, you will have $1,051.16. After two years, you will have $1,105.06. After 10 years, you will have $1,647.01. However, if you invest the same amount in a savings account that pays 5% annual interest but does not compound monthly, you will have only $1,500 after 10 years.

The difference between compound interest and simple interest becomes even more significant when you invest for longer periods of time or at higher interest rates. For example, suppose you invest $10,000 in a stock market index fund that pays 10% annual return compounded annually. After 30 years, you will have $174,494.02. However, if you invest the same amount in a bond fund that pays 10% annual return but does not compound annually, you will have only $40,000 after 30 years.

Start small – but do START!

Pound cost averaging is a strategy of investing a fixed amount of money at regular intervals, regardless of the market conditions. By doing this, you can reduce the risk of buying at the wrong time and benefit from the fluctuations in the prices of your investments. Pound cost averaging can help you achieve your long-term financial goals, such as saving for retirement, by smoothing out the market volatility and allowing your money to grow with compound interest.

To illustrate how pound cost averaging works, let’s compare two investors who invest in the same fund over a period of 12 months. Investor A invests £1,000 every month, while Investor B invests £12,000 as a lump sum at the beginning of the year. The table below shows the unit prices of the fund and the number of units purchased by each investor every month.

| Month | Unit price | Investor A | Investor B |

|---|---|---|---|

| January | £2.00 | 500 units | 6,000 units |

| February | £1.91 | 523 units | – |

| March | £1.74 | 574 units | – |

| April | £1.70 | 588 units | – |

| May | £1.65 | 606 units | – |

| June | £1.57 | 637 units | – |

| July | £1.52 | 658 units | – |

| August | £1.57 | 637 units | – |

| September | £1.61 | 621 units | – |

| October | £1.65 | 606 units | – |

| November | £1.74 | 574 units | – |

| December | £2.00 | 500 units | – |

At the end of the year, Investor A has invested a total of £12,000 and has accumulated 7,524 units, worth £15,048. Investor B has also invested a total of £12,000 and has maintained 6,000 units, worth £12,000. Therefore, Investor A has made a profit of £3,048, while Investor B has made no profit at all.

As you can see, pound cost averaging can help you take advantage of the market fluctuations and lower your average cost per unit. However, it is not a guarantee that you will make more money than investing a lump sum. There may be times when the market is consistently rising and investing a lump sum at the beginning would give you a higher return. Therefore, you should consider your risk appetite, time horizon, and investment objectives before choosing a strategy.

If you are interested in learning more about pound cost averaging and how it can benefit your long-term savings and investments, you can read some articles from reputable sources such as IG International, Royal London, or FT Adviser.

.

Leave a Comment