REITs: Good for long term wealth

This page may contain affiliate links. If you choose to purchase after clicking a link, I may receive a commission at no extra cost to you.

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate properties. They are modeled after mutual funds and pool the capital of numerous investors, making it possible for individual investors to earn dividends from real estate investments without having to buy, manage, or finance any properties themselves.

Here are some benefits of investing in REITs:

Steady Income Stream

REITs generate a steady income stream for investors through dividends. They are required by law to distribute at least 90% of their taxable income to shareholders annually in the form of dividends.

Liquidity

Most REITs are publicly traded like stocks, which makes them highly liquid (unlike physical real estate investments). Investors can buy and sell them like stocks throughout the trading session.

Diversification

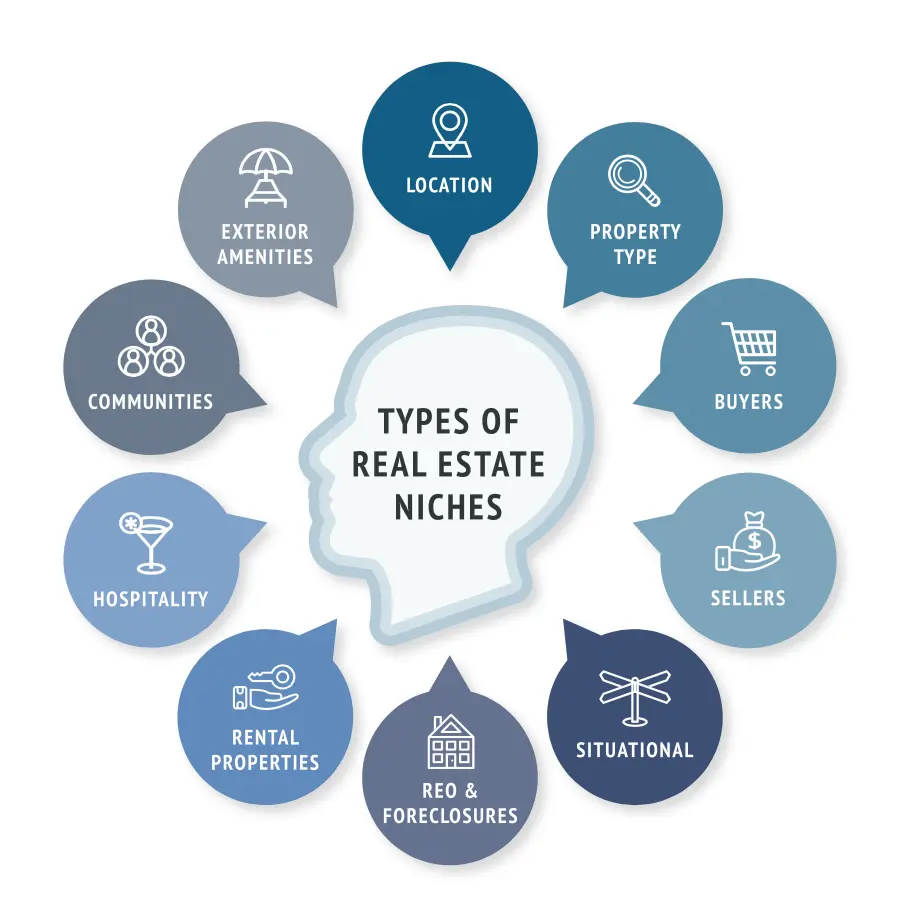

REITs invest in most real estate property types, including apartment buildings, cell towers, data centers, hotels, medical facilities, offices, retail centers, and warehouses. This diversification helps reduce investment risk by spreading it across different types of properties.

Accessibility

REITs offer an easier, more accessible, and more affordable way to earn from large-scale, profitable properties without having to pay for their full cost.

Total Return Investments

REITs are total return investments. They typically provide high dividends plus the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to be similar to those of value stocks and more than the returns of lower risk bonds.

Favourable Historical Returns

REITs have been a favorable choice for long-term investors. According to a report by Nareit, REITs have outperformed the broader stock market more often than not when returns are measured in years. The longer the time horizon, the more often REITs have outperformed stocks. For instance, when returns are measured over 19 years or greater, REITs outperform U.S. stocks every month.

A report by REIT.com shows that exchange-traded Equity REIT returns were much more dependable than stock returns: REIT returns over 10-year periods usually averaged between +10.0% and +13.3% per year and never fell short of +3.43% per year—even during the 10-year periods that included the liquidity crisis of 2008 to 2009—while stock returns were much more uncertain, usually averaging between +7.9% and +15.0% per year and actually going negative (by as much as -2.72% per year) during 17 periods that included the liquidity crisis.

Please note that past performance is no guarantee of future returns.

Please note that investing in REITs involves risks and uncertainties and is not suitable for everyone. It’s important to do your research and consult with a financial advisor before making any investment decisions.

Leave a Comment